Today, you need to find out what kind of loan to take and how much, not from the manager in the window of the bank, but on your own, relying on your own capabilities, using an online loan calculator to evaluate them. Banks are now ready to lend almost any amount, and besides Sberbank there are many more organizations with extremely attractive conditions. The question is, do you need a huge amount of debt? Can you pull the monthly payments? How to choose the best conditions?

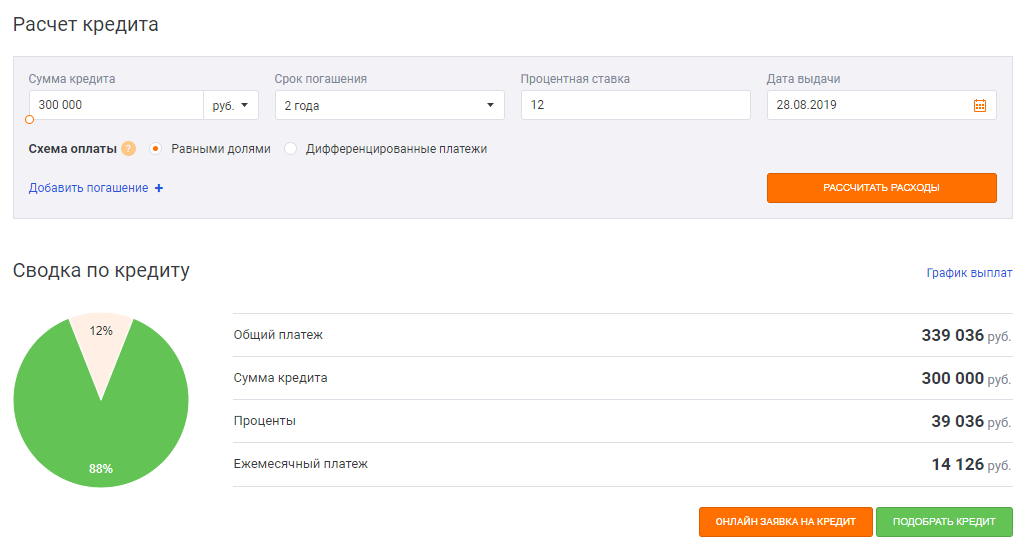

Convenient and easy to use service on the Vyberu.ru portal will answer all these questions. Online loan calculator makes it easy and simple to calculate all the necessary parameters. All fields are filled out based on your situation: what amount you want to borrow, for how long, for what interest rate you expect, what kind of debt repayment scheme is expected.

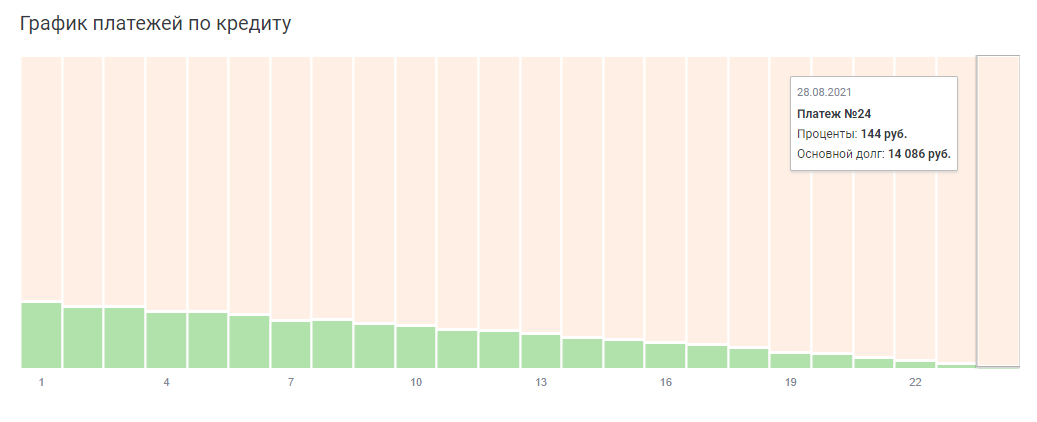

After filling in the fields, you will receive an approximate scheme for repaying the debt, as well as information which part of the payment will be used to pay interest and which part will be used to repay the principal loan amount. If you want to take a loan for a new car or gadget, then the amount of overpayment for the entire loan term will be important information. You can also see this in the calculator. Are you ready to overpay 40 thousand in two years (based on a loan for 300,000), or is it easier for you to wait, but get your accumulated cash without credit (and taking into account interest on deposits even more) 340,000? Everyone decides for himself. The calculator will show you all the information clearly.

A feature of the calculator at Vyberi.ru is the presence of a function for calculating the balance of the debt, taking into account an early payment. In this case, you can choose to reduce the monthly amount payable, or shorten the payment period. No need to neglect this feature. For example, you can plan to take out a loan in September and calculate the payment schedule. In this case, you and your spouse will be paid bonuses for the new year in the amount of 30,000 each. Entering this information, the calculator will tell you that the savings will be about 10,000 of the amount of interest (for example, we also take a loan of 300,000 for 2 years).

Another important feature - you will immediately see suitable offers from various banks. Now people often take loans from two or three of the largest banks. They do not need special advertising, and therefore the conditions may not be the most favorable. Indicate the down payment in the calculator, and on its basis you will be shown the best offers from banks. The interest on the loan is likely to be less than you expected. Besides, You will receive comprehensive information on the situation on the market of loan offers.

Take a loan, not understanding how much you will overpay and how much you will owe to the bank every month - frankly a bad idea. Of course, in the bank during registration, you will be informed of all the information, but there will not be much time to compare with other offers or think. Often, banks report that if you do not conclude a contract right now, then next time the conditions for may change. Do not fall for such phrases, pre-calculate all conditions in advance and select the most suitable offer for you.

Wood luminaires for contemporary spaces

Wood luminaires for contemporary spaces  Doors without platbands: how do they differ from ordinary ones

Doors without platbands: how do they differ from ordinary ones  Electric cornices - a new trend in modern interior design

Electric cornices - a new trend in modern interior design  An overview of the best online home goods stores

An overview of the best online home goods stores  Speedcheck - a new service for checking Internet speed

Speedcheck - a new service for checking Internet speed